form cp22a malaysia

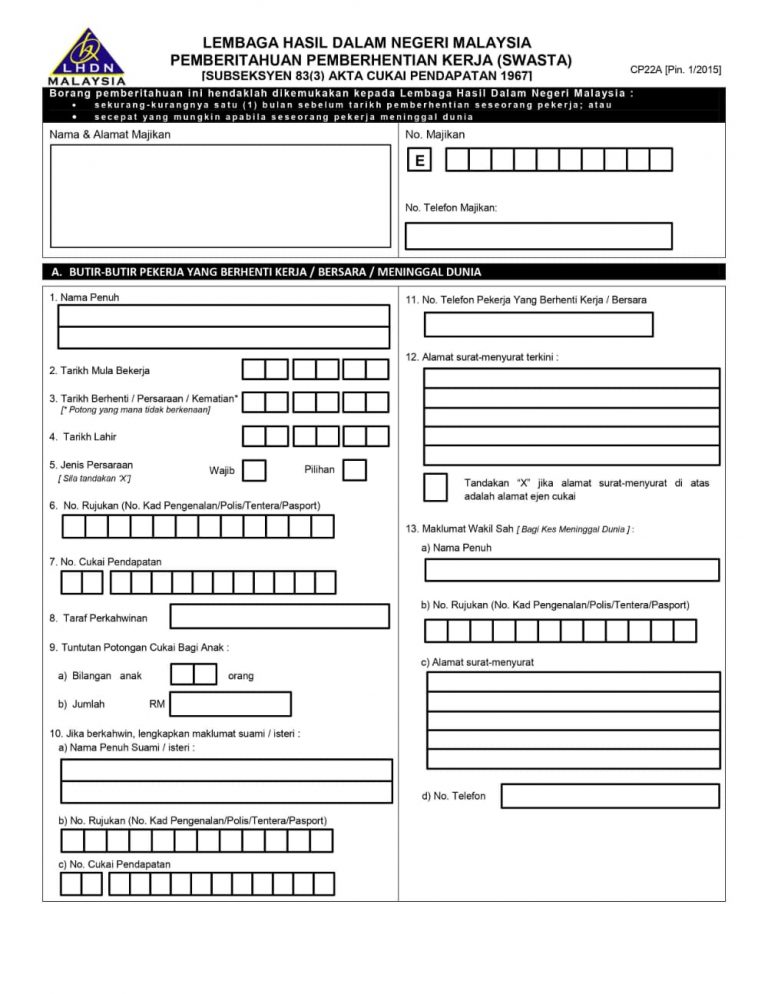

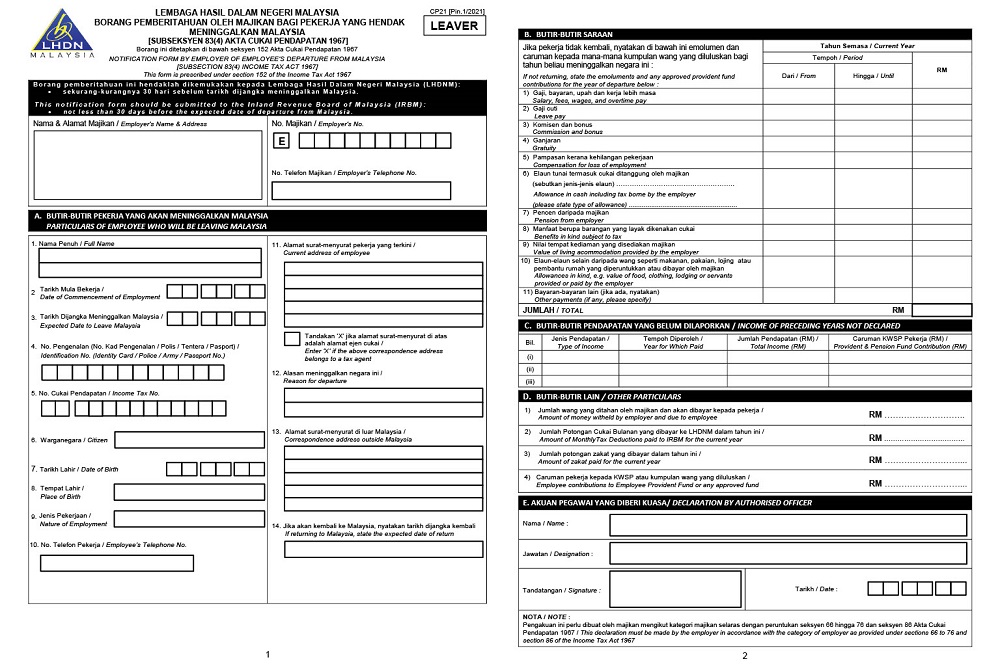

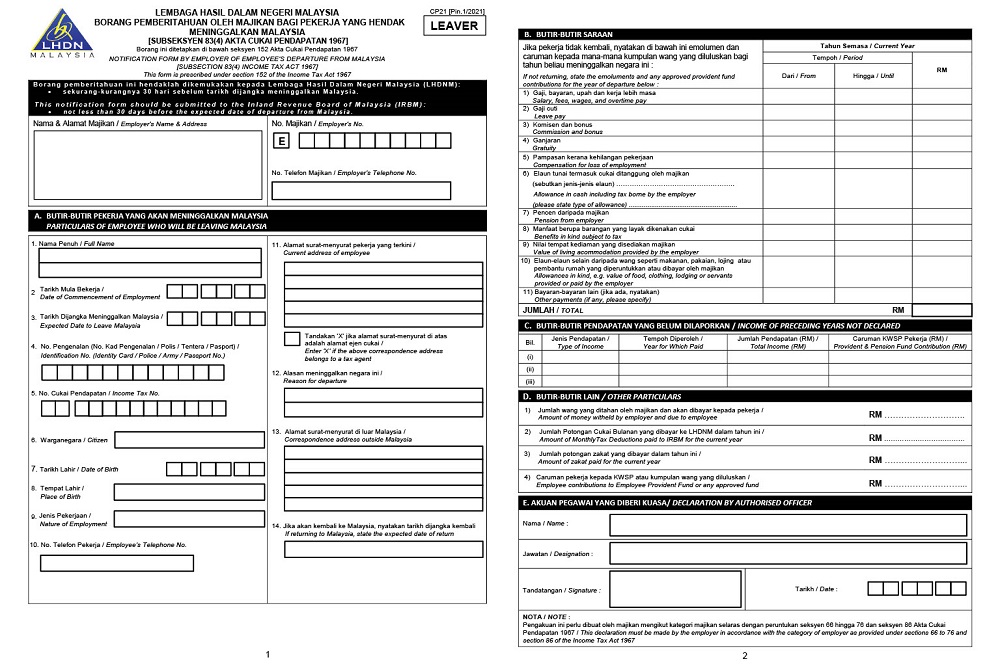

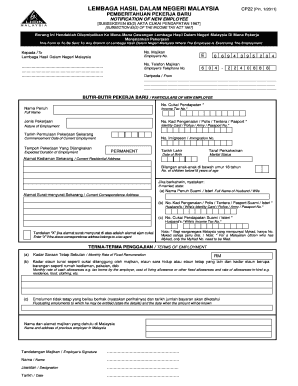

Criteria on Incomplete Form CP21 CP22 CP22A and CP22B Which is Unacceptable. The employee is about to leave Malaysia permanently in this case Form CP21 would be submitted instead of Form CP22A.

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

An important gateway to lucrative regional markets Malaysia has a developed economy that has grown over the past.

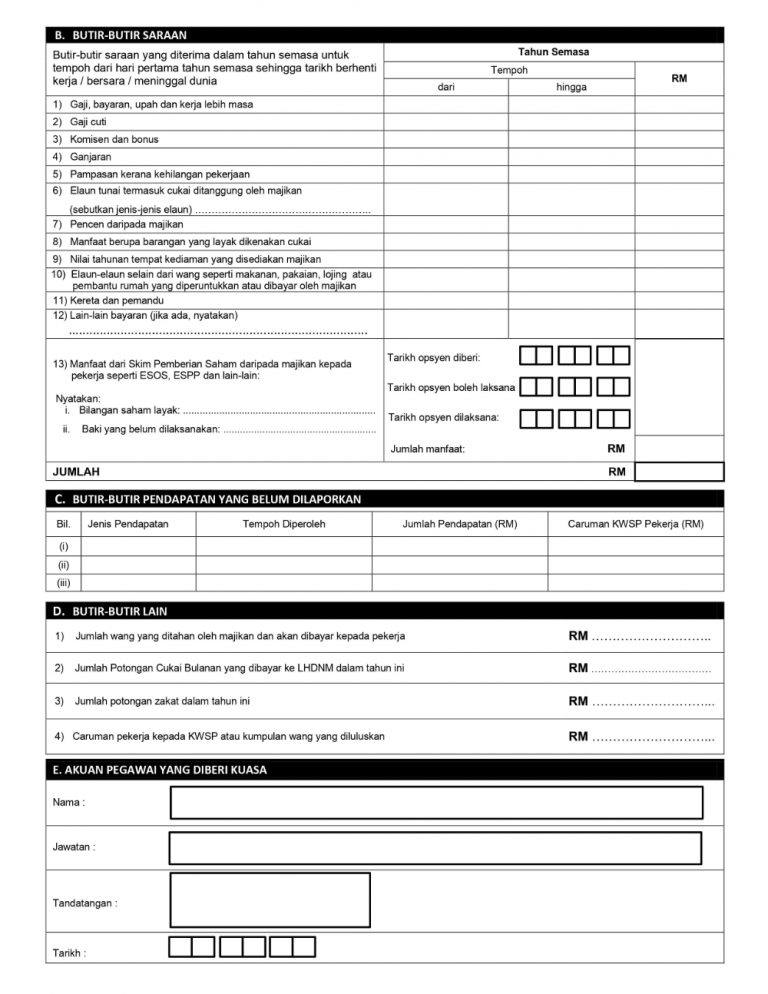

. All income accrued in derived from or remitted to Malaysia is liable to tax. Employers who have submitted. Retire or Cease from Employment in Malaysia Form CP22A.

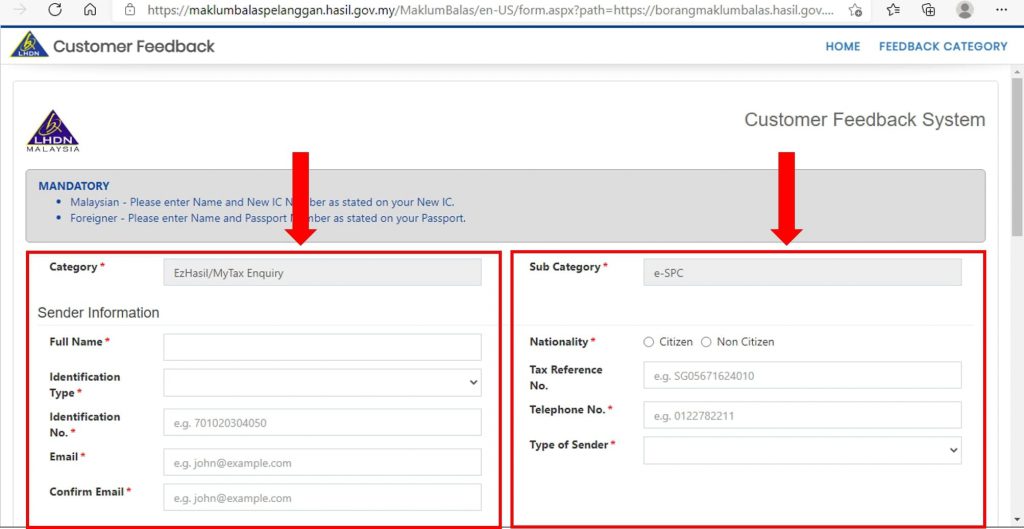

If you fail to do so you are liable to prosecution and if convicted liable to a fine of not less than RM200 and not more than RM2000 or to imprisonment for a term not exceeding six. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Headquarters of Inland Revenue Board Of Malaysia.

Like many other jurisdictions Malaysia has its own taxation system. Employee is about to leave Malaysia permanently. Leaving Malaysia for a period exceeding 3 months.

Employee is about to retire. Malaysia is separated into two landmasses by the South China Sea. Death of an employee.

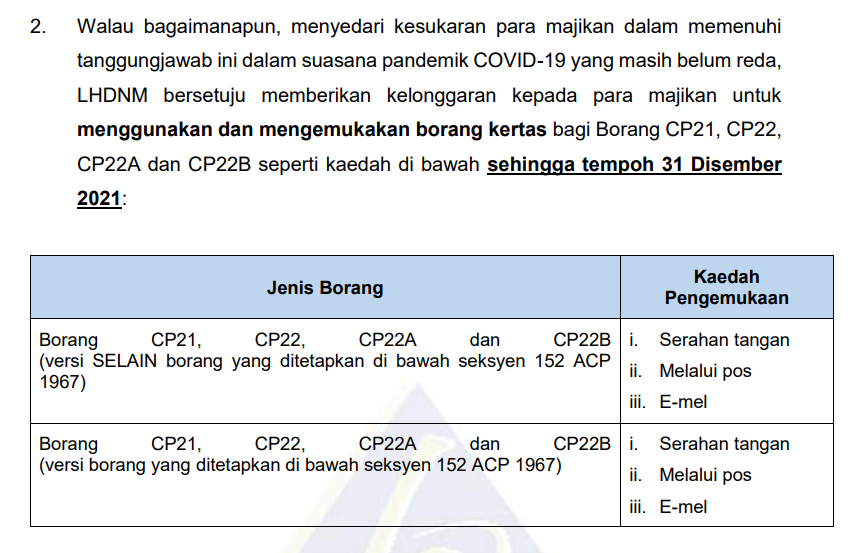

LEMBAGA HASIL DALAM NEGERI MALAYSIA CP22A Pin12021 BORANG PEMBERITAHUAN PEMBERHENTIAN KERJA SWASTA SUBSEKSYEN 833 AKTA CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967. Employee is subject to MTD and employer has not made any deduction. That said income of any person other than a resident company carrying on the.

The western landmass known as Peninsular Malaysia is bordered to the north by Thailand and to the south by Singapore while the eastern landmass East Malaysia is bordered by Brunei and Indonesia. Borang pemberitahuan ini hendaklah dikemukakan kepada Lembaga Hasil Dalam Negeri Malaysia LHDNM. Form E will only be considered complete if CP8D is submitted within the stipulated deadline.

Employer is responsible for notifying Inland Revenue Board Malaysia where the employee ceases employment if. 3Submit return form of employer Form E together with the CP8D on or before 31 March of the following year. Or The employee was eligible for PCB but no deductions were made.

Employer company and Labuan company is compulsory to submit Form E via e-Filing e-E with effect from remuneration for the year 2016. The employer is required to notify MIRB and apply for SPC not later than 30 days before the date of the employees expected date of departure termination of employment or in the case of death within 30 days after the death. Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers.

Download Your Personal Tax Clearance Letter Cp22 Cp22a

What Is Cp22 And Cp22a And How They Realted To Your Company

What Is Cp22 And Cp22a And How They Realted To Your Company

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Changes In New Year 2022 Inland Revenue Board Lhdn

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Cp22 Form 2021 Online Submission Fill Online Printable Fillable Blank Pdffiller

Download Your Personal Tax Clearance Letter Cp22 Cp22a

Changes In New Year 2022 Inland Revenue Board Lhdn

What Is Cp22 And Cp22a And How They Realted To Your Company

What Is Cp22 And Cp22a And How They Realted To Your Company

N F M Panduan Cukai Berhenti Kerja

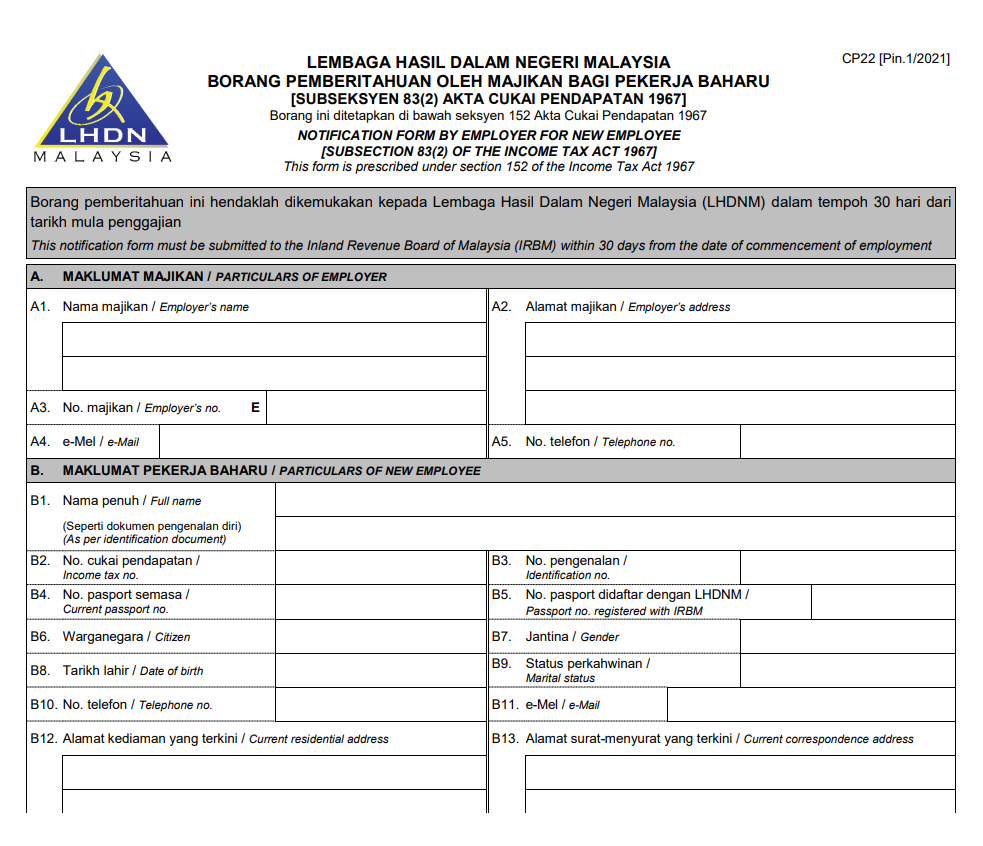

St Partners Plt Chartered Accountants Malaysia Tax Audit On Employer Need Provide Form Cp21 Cp22 Cp22a Kindly Be Informed That Form Cp21 Cp22 Cp22a And Cp22b Version Amendment

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

No comments for "form cp22a malaysia"

Post a Comment